SIPPs explained

Pensions are a long-term investment. The retirement benefits you receive from your pension account will depend on a number of factors including the value of your account when you decide to take your benefits which isn't guaranteed, and can go down as well as up. The value of your account could fall below the amount paid in. Tax treatment depends on individual circumstances and may be subject to change in the future.

Tax relief

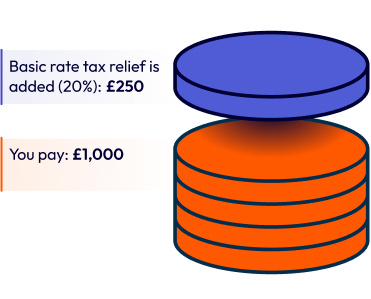

A basic rate taxpayer:

Total contribution of £1,250

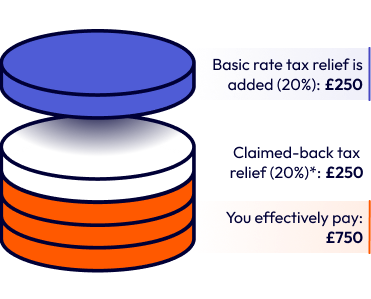

A higher rate taxpayer:

Total contribution of £1,250

*By claiming back the extra 20% higher rate tax relief through self-assessment, this effectively means you’ve only paid £750 towards a £1,250 total pension contribution. If you live in Scotland, or are an additional rate taxpayer, the reclaimed tax amount could be more.

-

How you receive the pension tax relief you’re entitled to depends on the type of pension you’re paying into:

- If you have a personal pension, because you’ve already been taxed on the income you’re paying in, it needs to be added back. Your pension provider claims tax relief for you from HMRC to automatically add the basic rate of 20% to your pot. If you’re a higher or additional rate taxpayer, you need to claim back the additional tax you’re eligible for through your yearly Self-Assessment.

- If you have a workplace pension, your employer usually takes your pension contributions out of your pay before deducting Income Tax. This means you haven’t paid tax on these contributions, so you don’t need to claim anything back.

-

If you pay tax at a higher rate than basic tax rate, you can claim any further tax relief to which you are entitled through self-assessment. If you are a Scottish tax payer and you pay tax at a rate higher than the basic rate, you’ll be entitled to claim further tax relief at that higher rate. If you pay tax at lower than the basic rate of tax, you’ll still be entitled to receive tax relief at the basic rate.

Interest in your SIPP

Current interest paid

- We hold uninvested cash in a central client money account, in compliance with Financial Conduct Authority (FCA) rules.

- Your money is protected under the Financial Services Compensation Scheme (FSCS).

- The retained interest is the difference between the total amount we receive from our banking partners and the amount we pay to customers.

- Please note that all interest rates can vary.

|

Interest rate paid to you |

From |

|---|---|

|

Interest rate paid to you 3.00% |

From 28/08/2025 |

|

Interest rate paid to you 3.55% |

From 31/08/2023 |

|

Interest rate paid to you 2.65% |

From 23/03/2023 |

|

Interest rate paid to you 2.45% |

From 19/01/2023 |

|

Interest rate paid to you 1.30% |

From 07/10/2022 |

SIPP beneficiaries

When you die, your SIPP (Self-Invested Personal Pension) can be passed to your beneficiaries, usually free from Inheritance Tax. You can nominate as many beneficiaries as you like, such as a spouse and a child, or a charity. Who you choose is up to you but it’s always worth regularly reviewing, especially as your life and circumstances change.

Your beneficiaries can choose to receive their benefits in one of the following ways:

- as a cash lump sum (normally not subject to Inheritance Tax)

- as a guaranteed yearly income, by buying an annuity from an annuity provider (which will normally pay a regular, secure income for the rest of their life), or

- as a flexible income, by setting up a beneficiary drawdown (leaving the pension invested with potential to also pass on savings to future generations).

Some of these benefits may be taxed but this will depend on what you’ve done with your pension and your circumstances at the time of your death.

To nominate or change your beneficiaries, you should contact us.

Taking money from your pension

Once you reach the age of 55 (57 from 2028), you can start taking an income from your SIPP, or you can choose to keep your money invested and continue to contribute to your pension pot.

-

If you need to take an income or need access to the money in your pension, you can choose any, or a combination, of the below options.

- Leave it invested

- Take it as cash

- Flexible income through drawdown

- Buy an annuity

-

While you can generally take 25% of your SIPP as a tax-free lump sum, please be aware that this is capped by the lump sum allowance, which is currently £268,275.

There is also the lump sum and death benefit allowance, currently £1,073,100. This puts a limit on the tax-free lump sums that can be paid on your death. (Note that this is reduced by any tax-free lump sums you take during your lifetime).

As of 6 April 2024, there are no limits on how much of your SIPP you can convert to income drawdown or an annuity, whether during your lifetime or on death.

There is also a limit once you start taking money from your SIPP - this could be a withdrawal from your flexi-access drawdown or taking a taxable lump sum, called the Money Purchase Annual Allowance (MPAA). The MPAA limit impacts the amount you can pay into your SIPP in the future without incurring a tax charge. This limit is currently £10,000 each tax year (although the Government may change this in future).

-

You can update any of the following as part of your regular income at any time:

• The amount of your pension income.

• Payment date.

• Payment frequency.

• Bank details.

Be aware that changes will usually take up to 10 working days to complete.

If you're increasing your income payments from your SIPP, be aware of the following:

Sustainability of funds: Make sure you have enough funds to support the increased withdrawals over the remaining term of your retirement. Drawing too much too soon could deplete your pension earlier than expected.

Tax Implications: Increasing your income may push you into a higher tax bracket. This could result in a larger portion of your income being taxed at a higher rate. We recommend seeking tax advice to understand the full impact.

Investment suitability: Review your investment choices to check they are appropriate for your needs. Your investment strategy should align with your income requirements and retirement needs. If you need any help and guidance, you can get this free through Pension Wise. If you need any financial advice, we recommend you speak with a financial adviser. They'll charge you for this service. You can visit Unbiased or Vouchedfor to find a financial adviser near you.

We're all part of Lloyds Banking Group, which incorporates many well-known companies including Halifax, Scottish Widows, Halifax Share Dealing Limited and Embark Investment Services Limited.

Our retirement partner for our pensions is Scottish Widows, who have more than 200 years experience in pensions and retirement.

Understanding the risks

The main goal of any pension scheme is to provide you with an income during retirement. There are some important things to think about that could affect the benefits you’re able to receive in the future.

-

Before transferring benefits into your SIPP from another pension provider, you should check you aren’t giving up valuable features or benefits.

Although we don’t charge you, your existing pension provider may apply a penalty, or other reduction in the value of your benefits, if it’s transferred.

If you transfer money into your SIPP from another pension, the final pension benefits you receive could be less than if you stayed in your existing scheme.

If you’re in any doubt about the benefit of transferring, we recommend that you take advice from a suitably qualified, professional adviser before arranging the transfer. There will normally be a charge for that advice.

-

Most experts will tell you not to keep all your eggs in one basket, as it’ll help you to diversify and manage your overall risk appetite.

You can deal in a wide range of investments, each of which carries a different level of risk. The value of your SIPP depends on the level of risk and potential performance of the investments you choose. It’s always worth doing your research first but past performance is not a guarantee of how investments will perform in the future.

But remember, investment performance can go down as well as up and you may get back less than you originally invested. Some investments may need to be held for longer term to achieve a return.

If the value of your SIPP is small and you deal regularly in smaller amounts, dealing costs could be disproportionately high and weaken the value of your SIPP.

-

Your retirement benefits are not guaranteed. If you start to take income earlier than planned, the total amount may be lower than expected and may not meet your needs in retirement.

Your SIPP value may not be large enough to provide income for as long as you wanted, in instances where you take a higher than planned level of income (for example as a flexi-access Drawdown) over a long period of time.

If you take a large proportion of income in a short period, you may end up paying a higher rate of tax than usual.

Halifax Share Dealing Limited and Embark Investment Services Limited are participants in the Financial Services Compensation Scheme. Customers may be able to make a claim on this scheme if we default in our obligations to them. Compensation of up to 100% of the first £85,000 of assets held with each legal entity may be available to eligible claimants.

This is in addition to any other savings deposits you may hold across Lloyds Banking Group.

The Scottish Widows SIPP is provided by Embark Investments Services Limited (EISL), which is a wholly owned subsidiary of Embark Group Limited. EISL, is a company incorporated in England and Wales (company number 09955930) and is authorised and regulated by the Financial Conduct authority (Financial Services Register number 737356).

Dealing and stockbroking administration services for the Scottish Widows SIPP are provided by Halifax Share Dealing Limited (HSDL), which is a wholly owned subsidiary of Embark Group Limited and part of Lloyds Banking Group. HSDL is a company incorporated in England and Wales (company number 3195646) with its registered office at: Trinity Road, Halifax, West Yorkshire, HX1 2RG. HSDL is authorised and regulated by the Financial Conduct Authority (Financial Services Register number 183332). HSDL is a member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.