Charges

ISA and Share Dealing Account charges

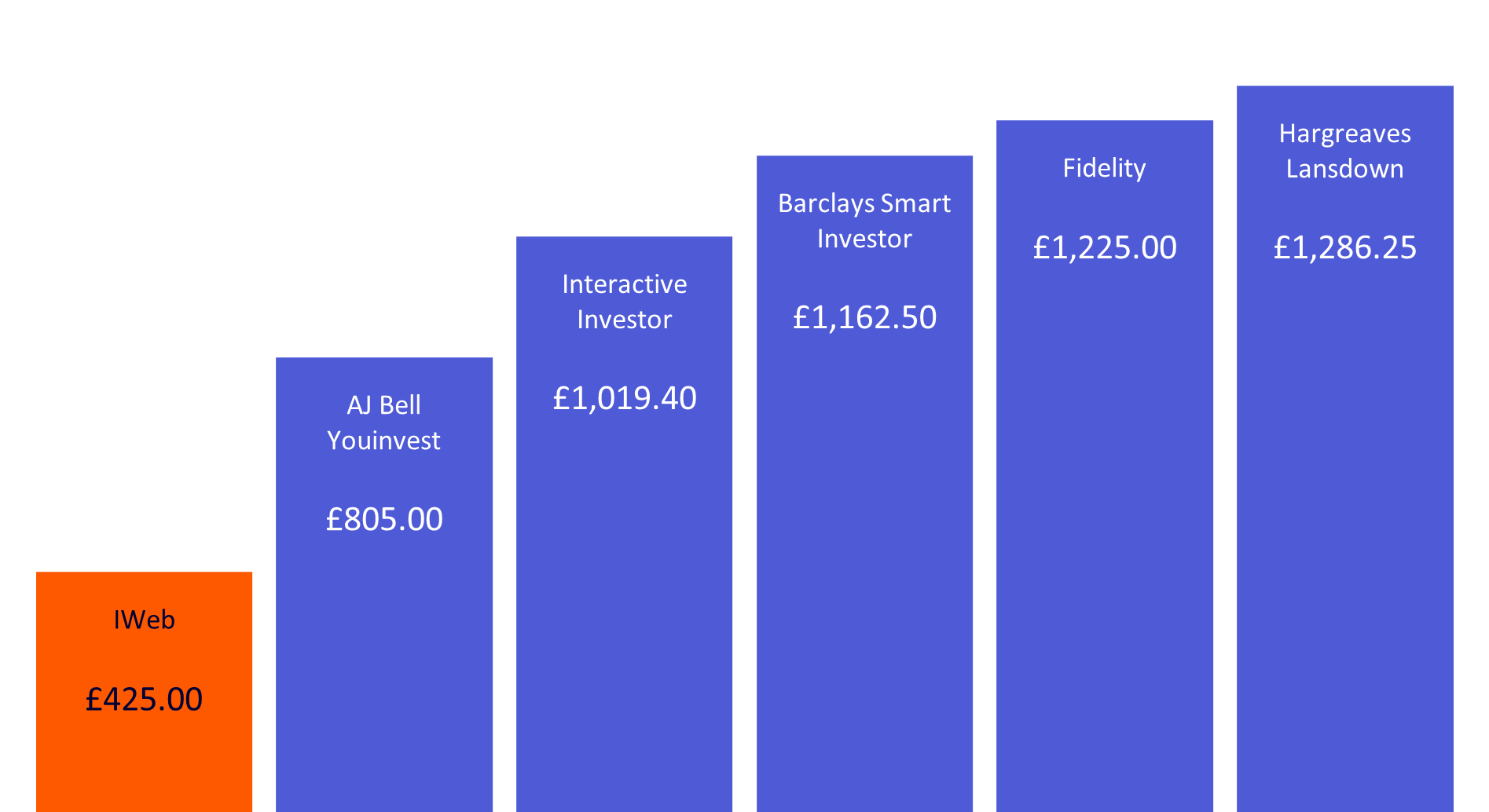

Compare what an average IWeb customer would pay

Over five years you could save up to £861.25 in platform charges.

This chart is based upon a five year projection of an average IWeb customer – see how we calculated this.

It excludes fund manager costs which may vary depending on the share class available on each platform, you can find these in the fund’s Key Investor Information Document. In addition you may have to pay government taxes or levies.

Data has been taken from a selection of comparable competitor websites and is correct as at 28 July 2025. These could potentially change in the future.

-

IWeb £425.00

AJ Bell Youinvest £805.00

Interactive Investor £1,019.40

Barclays Smart Investor £1,162.50

Fidelity £1,225.00

Hargreaves Lansdown £1,286.25

Additional trading charges

Sometimes there are extra charges for certain trades and transfers:

-

When you buy or sell an international stock, the share price is converted into GBP. We adjust the exchange rate by 1.5% and keep the difference as our fee.

The exchange rate is provided by Digital Look and an indicative rate will be provided before you place your order. The rate applicable to the individual trade will be confirmed on the contract note once the trade is finalised.

-

Dividend reinvestment purchases are charged at 2% of the dividend value, and capped at a maximum of £5 per stock.

-

We offer a range of TradePlans (including limit orders and stop losses) to help you control the risk involved with stock market investing. TradePlans are available on any CREST eligible UK stock.

Charges in a Share Dealing Account

When you set-up a TradePlan in a Share Dealing Account we will charge you £2. If a trade is executed as part of the TradePlan we'll then reduce your dealing commission charge by £2. You'll pay for each new TradePlan you set-up so if you amend your current TradePlan or it expires, it'll cost you £2 to set-up a new one.

Charges in a Stocks and Shares ISA or SIPP

For ISAs and SIPPs there is no charge to set-up a TradePlan. This means our standard commission rate will apply to any trade carried out if a TradePlan triggers.

-

Transfer in (stock or cash): Free

Transfer out (stock or cash): FreeThe other provider may charges fees so please check before you start your transfer.

-

Fund Managers will charge various fees such as an ongoing charge or transaction fees, and details of these can be found within the Key Investor Information Document for each fund.

-

Stamp Duty

When you buy a UK stock, you’ll pay a form of tax called Stamp Duty to the Government. Stamp duty is 0.5% of the value of the investments you buy (1% on Irish stocks) and you won’t pay any Stamp Duty on AIM stocks or Exchange Traded Funds.

Spanish Transaction Tax

Spanish Transaction Tax (0.2%) is an additional tax payment when you buy some Spanish stocks e.g. Banco Santander and International Consolidated Airlines Group.

PTM Levy

Any trade over £10,000 will also be liable for a levy of £1.50 which is paid to the Panel on Takeovers and Mergers (PTM).