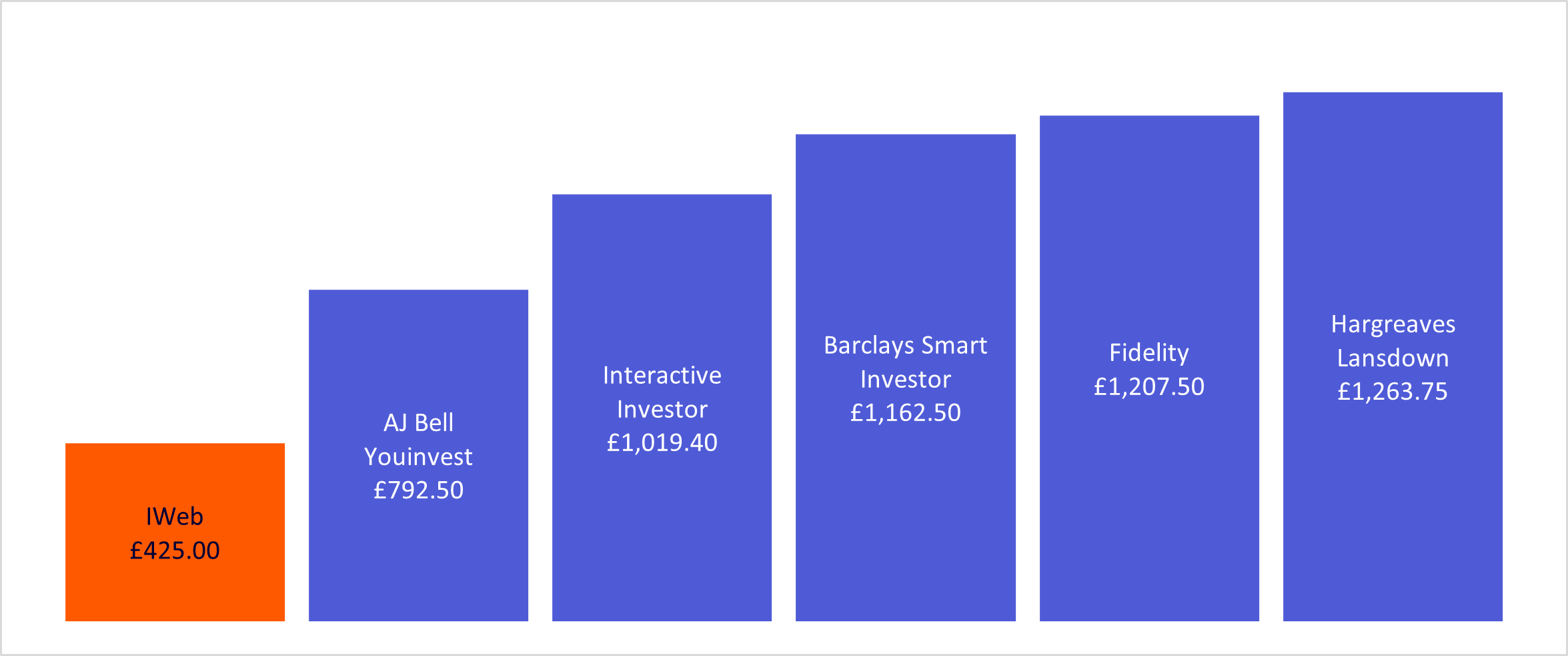

Compare our charges

What an average IWeb ISA customer would pay

Over 5 years you could save up to £838.75 in platform charges.

Data has been taken from a selection of comparable competitor websites and is correct as at 23 October 2025. These could potentially change in the future.

-

IWeb, £425.00

AJ Bell Youinvest, £792.50

Interactive Investor, £1,019.40

Barclays Smart Investor, £1,162.50

Fidelity, £1,207.50

Hargreaves Lansdown, £1,263.75

Our calculations

We have used our data about how the average IWeb ISA customer uses their account to show you how much they would pay in fees over 5 years.

|

Average amount for an IWeb customer |

Calculation |

Total cost |

|---|---|---|

|

Average amount for an IWeb customer 4 UK trades |

Calculation £5 for each trade |

Total cost £20.00 |

|

Average amount for an IWeb customer 1 Fund trade |

Calculation £5 for each trade |

Total cost £5.00 |

|

Average amount for an IWeb customer 1 US trade of £4,000 |

Calculation 1.5% FX charge |

Total cost £60.00 |

Why are we showing this information?

Why five years?

Why have we picked these competitors?

What if I don’t want to trade like an ‘average IWeb customer’?

Not everyone is the same and you are able to use your IWeb account in whatever way best suits you. You can use our full list of charges to work out what you would pay.

What would you pay with our competitors?

The table below shows the breakdown of charges an average IWeb ISA customer would pay with 5 of our competitors:

|

Customer activity |

Hargreaves Lansdown |

Fidelity |

AJ Bell Youinvest |

Barclays Smart Investor |

Interactive Investor |

IWeb |

|---|---|---|---|---|---|---|

|

Customer activity £41,000 held in shares |

Hargreaves Lansdown £45.00 |

Fidelity £90.00 |

AJ Bell Youinvest £42.00 |

Barclays Smart Investor £102.50 |

Interactive Investor No charge |

IWeb No charge |

|

Customer activity £24,000 held in funds |

Hargreaves Lansdown £108.00 |

Fidelity £84.00 |

AJ Bell Youinvest £60.00 |

Barclays Smart Investor £60.00 |

Interactive Investor No charge |

IWeb No charge |

|

Customer activity 4 UK trades |

Hargreaves Lansdown £47.80 |

Fidelity £30.00 |

AJ Bell Youinvest £20.00 |

Barclays Smart Investor £24.00 |

Interactive Investor £0.00 |

IWeb £20.00 |

|

Customer activity 1 Fund trade |

Hargreaves Lansdown £0.00 |

Fidelity £0.00 |

AJ Bell Youinvest £1.50 |

Barclays Smart Investor £0.00 |

Interactive Investor £0.00 |

IWeb £5.00 |

|

Customer activity 1 International trade of £4,000 value |

Hargreaves Lansdown £51.95 |

Fidelity £37.50 |

AJ Bell Youinvest £35.00 |

Barclays Smart Investor £46.00 |

Interactive Investor £60.00 |

IWeb £60.00 |

|

Customer activity Administration charge |

Hargreaves Lansdown No charge |

Fidelity No charge |

AJ Bell Youinvest No charge |

Barclays Smart Investor No charge |

Interactive Investor £143.88 |

IWeb No charge |

|

Customer activity Year 1 cost |

Hargreaves Lansdown £252.75 |

Fidelity £241.50 |

AJ Bell Youinvest £158.50 |

Barclays Smart Investor £232.50 |

Interactive Investor £203.88 |

IWeb £85.00 |

|

Customer activity 5-year cost |

Hargreaves Lansdown £1,263.75 |

Fidelity £1,207.50 |

AJ Bell Youinvest £792.50 |

Barclays Smart Investor £1,162.50 |

Interactive Investor £1,019.40 |

IWeb £425.00 |

|

Customer activity 5-year cost difference |

Hargreaves Lansdown £838.75 |

Fidelity £782.50 |

AJ Bell Youinvest £367.50 |

Barclays Smart Investor £737.50 |

Interactive Investor £594.40 |

IWeb ‐ |

Data has been taken from competitor websites and is correct as at 23 October 2025. These could potentially change in the future.