IWeb is now Scottish Widows Share Dealing

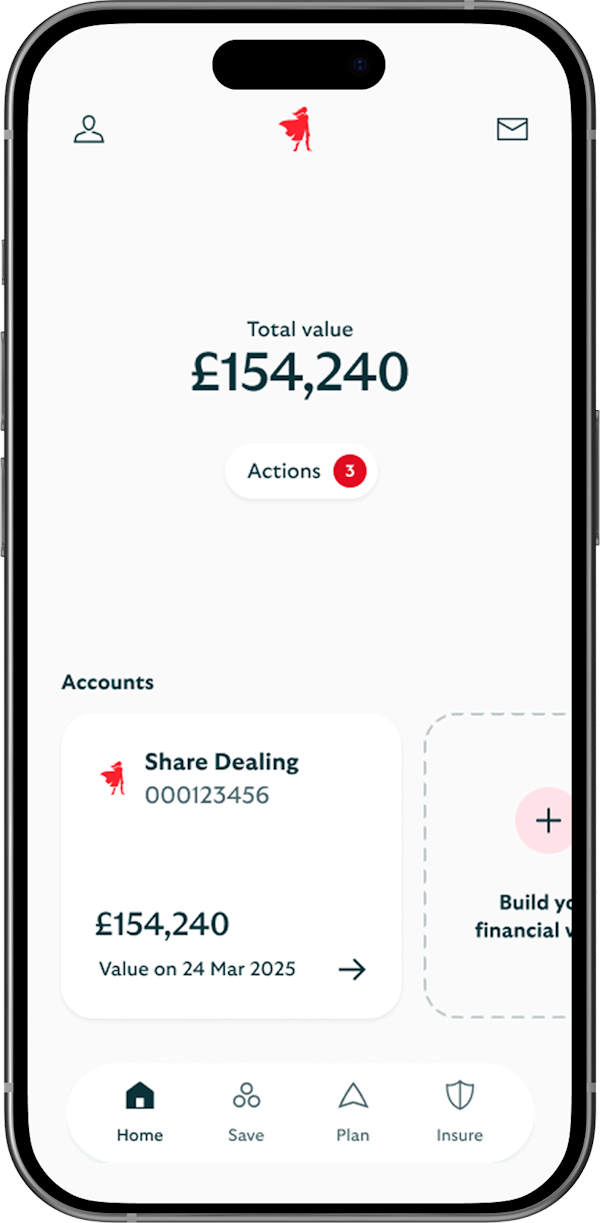

The new home for IWeb

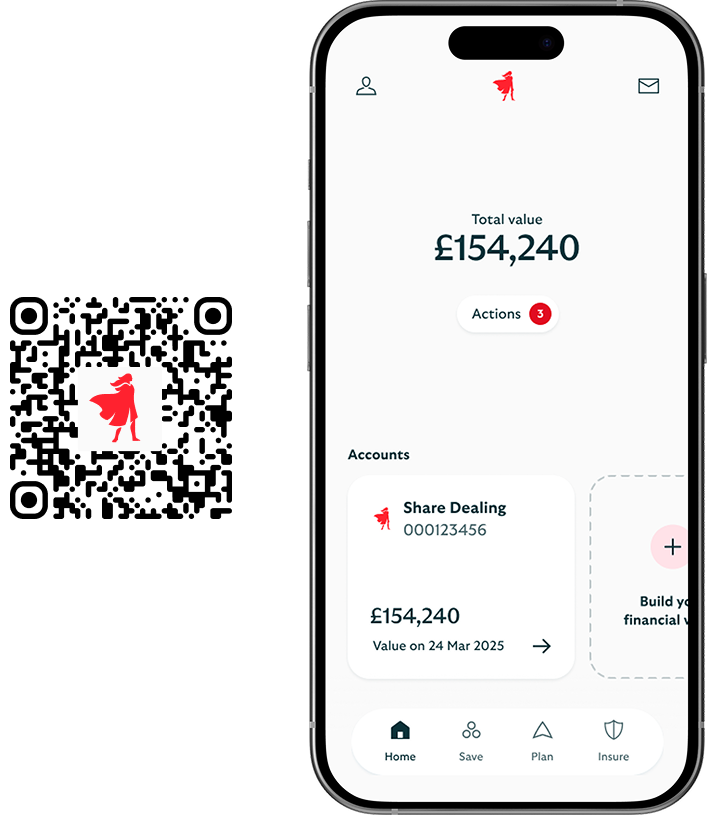

You can log in as usual at the top of this page, or visit our new Scottish Widows website to explore our accounts and services.

Easily find what you’re looking for

We’re here to help you navigate the new changes. Just remember to bookmark any links you’ll want later.

The new home for your financial future

The Scottish Widows Share Dealing, previously known as IWeb Share Dealing, Service is operated by Halifax Share Dealing Limited. Registered in England and Wales no. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.